[They say that hindsight is 20/20. So I’ll preface this post with the fact that I was making this argument years ago, as in 2010, well before ZIP ever went public. (A quick search of my Gmail for Zipcar IPO did the trick.)]

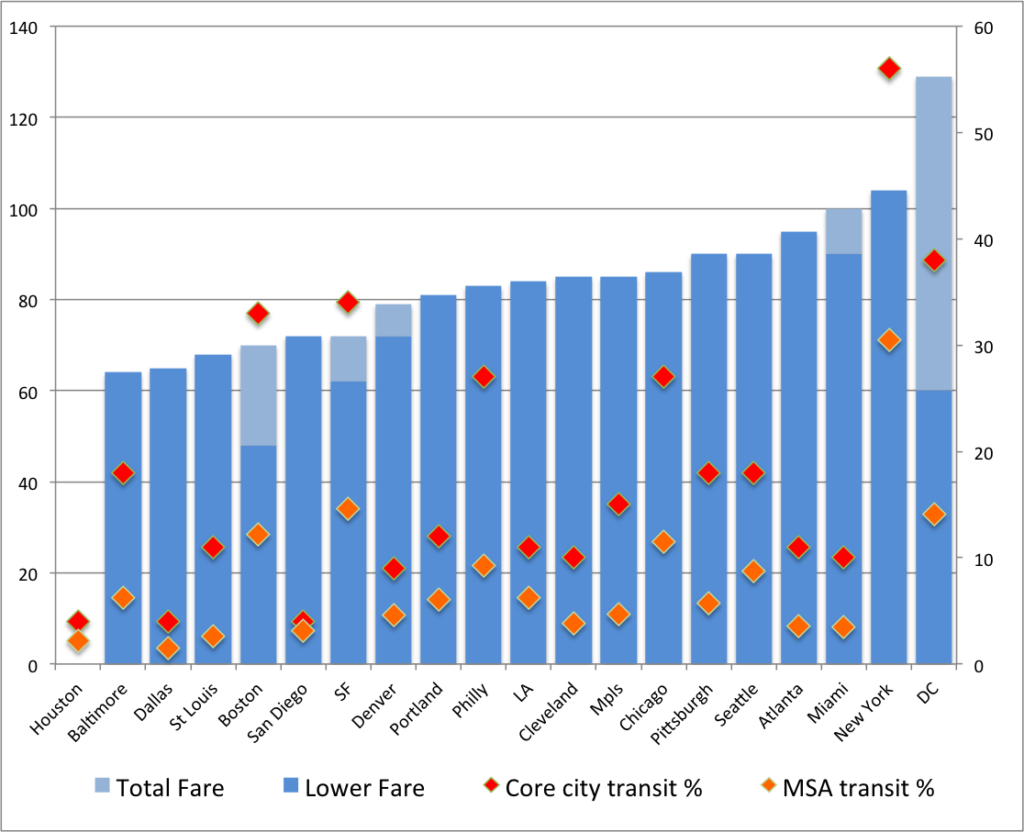

Car sharing is great. It’s not applicable to every market (i.e. it works better in Boston than Houston) and in the short term, outside of dense cities with pricey parking it will be a niche product. But its users dramatically reduce the number of cars on the road, and they also reduce the amount that they drive when they pay the full cost of driving, not just the marginal cost after the static costs of insurance, depreciation and parking. From its infancy less than 15 years ago (most large city car sharing organizations—CSOs—launched between 1998 and 2002) it has grown to an almost-mainstream product with close to 10,000 cars and a million drivers in North America.

But I’m not about to invest in it. And Zipcar (ZIP), which went public last year, has promptly lost two thirds of its value.

Zipcar’s aim in an IPO was to both pay back their initial investors and raise money for expansion. However, as they expand, they are not going to be able to exploit economies of scale in the way many growing companies can. They have entered their best markets, and further expansion will be in to markets with lower margins and which require more marketing and long term demographic change (Atlanta instead of Boston). The heady days of the early ’90s, when car sharing organizations in dense cities threw cars on to the streets as fast as they could, have come to a close. The top neighborhoods are well-served. Future expansion will be slow and methodical, and not particularly profitable.

In fact, several successful car sharing organizations don’t really ever intend to turn a profit. The following are major car sharing organizations in the US and Canada:

- Zipcar, for-profit start-up, founded 2000 in Boston, main vendor in Boston, New York, DC, Portland and Seattle, with a presence in all large markets except Montreal. Bought Flexcar (for-profit) in 2007; Flexcar had originally been formed as a public-private partnership in Seattle in 2000, and bought a Portland-based not-for-profit (Car Sharing Portland) in 2002 before expanding and being bought by Zipcar, apparently close to bankruptcy.

- Hertz on Demand, for-profit spinoff of car rental agency, founded 2008, New York

- Mint, for-profit spinoff of parking garage manager, founded 2008, New York

- City CarShare, independent not-for-profit, founded 2000 in San Francisco (for a couple of years, San Francisco had competition between CCS, Zipcar and Flexcar)

- I-Go, not-for-profit division of a larger organization, founded 2002, Chicago

- PhillyCarShare, not-for-profit start-up in 2002 sold to Enterprise in 2011

- CommunAuto, for-profit start-up in Montreal in 1994

- Autoshare, for-profit start-up in Toronto, 1998

- Modo, founded as The Car Coop, cooperative founded in Vancouver in 2000

- Most smaller CSOs are non-profits (HOURCAR, Ego, Ithaca Carshare, Carshare VT) with a few for-profits (CommunityCar, OccasionalCar) and coops as well.

Interestingly, every city with even a medium-sized car sharing scheme, except New York and Washington D.C., has had, at one point, it’s own homegrown car sharing service. Zipcar only succeeded in using it’s size to run Flexcar in to merging (and this may have been more due to management policies on Flexcar’s part) and PhillyCarShare to a sale (again, quite possibly due to management issues). Washington, D.C. is the only city in which competition has markedly decreased (it and San Francisco had Zipcar-Flexcar competition before that merger; San Francisco retains competition with CityCarShare); the rest of the markets Zipcar has entered it has failed to dislodge the existing player in town. (That being said, with the exception of New York no one has entered a Zipcar market after they had established a presence.)

But look at how the major players were founded:

- 4 as for-profit start-ups

- 2 as other for-profits (Both in the New York market)

- 4 as not-for-profits

- 1 as a coop

About half of the players in car sharing started off as non-profits, and two (I-Go and CityCarShare) remain non-profit today. I’d be reticent to invest in a business model where nearly half of the original founders didn’t see the opportunity or necessity for profits.

There are three main issues which will keep car sharing from ever being a terribly profitable business. (Yes, it likely will achieve a steady level of profitability in some markets and may pay small returns to investors, but won’t grow dramatically.) One is the issue of car sharing being a capital-intensive business. The second is that, charging by time, CSOs are hamstrung by there being only 24 hours in a day. Finally, for both mission and practical reasons, car sharing organizations are one of very few businesses which often actively encourage their customers to use their product as little as possible. None of these helps the bottom line.

As far as capital goes, car sharing is expensive. CSOs have to buy (generally) new cars, install a couple thousand dollars of hardware, and continually maintain them. Unlike rental car companies, which can sell their fleet seasonally or to adjust to market conditions, CSOs decal their vehicles and install locking mechanisms, relays and mileage tracking devices. These investments raise the barrier to selling capital quickly, and most CSOs keep their vehicles for several years, not several months. Having a lot of capital tied up in depreciating assets encourages stability and slow growth, but not necessarily high profits.

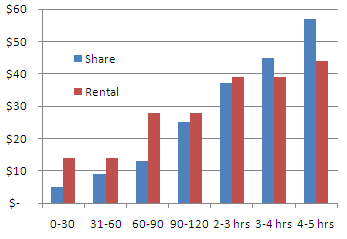

With millions of dollars of capital tied up in vehicles, car sharing organizations are hamstrung by the number 24: the number of hours in a day. This, however, is misleading, because very little car sharing takes place overnight, when many CSOs have reduced rates. In addition, most car sharing organizations have daily rates, which allow consumers to cap the cost of a shared car at around the cost of an 8 hour rental, but this also caps the potential revenue at 8 hours. Since car sharing breaks even with between 5 and 6 hours of use per day, this leaves a small margin for profitability. And even without daily rates, customers become agitated when availability dips, generally around 9 hours a day (50%, assuming the hours of 12 to 6 a.m. rarely see car usage).

Is there room for profitability between the break-even point and the daily rate barrier? Yes, but not much. Usage is lower on weekdays, and if cars saw maximum profitability on weekdays they’d be swamped on weekends. Thus, most CSOs have higher rates on weekends (this is what we call supply and demand). And since the fixed costs of buying, parking and insuring a vehicle is quite high, there is little room to reduce the break-even point. Some cars in high-use areas will always profit, but a CSO will generally have fringe cars in neighborhoods which see less use (but absorb extra demand and expand the geographical market). And cars which do very well in the summer often see usage decline in the winter, but with annual parking space contracts and investments, CSOs can’t change their fleet size based on the season. So making a profit in car sharing is akin to threading the needle of a balance sheet.

Finally, once a member joins a car sharing organization, they aren’t generally encouraged to drive as much as possible. For one thing, some members might find that, by driving a lot, they would be financially better off buying a car, depriving a CSO of a highly-valued member. In addition, non-profit CSOs, and many of their for-profit brethren, are motivated by environmental goals, and find it hard to encourage their members to “drive as much as you can!” So car sharing is one of very few businesses where a consumer is told to buy a product and then use it as little as possible. (Imagine, for instance, McDonalds running ads saying “cheeseburgers are a great alternative to eating at home, but really you should eat our cheeseburgers only when you’re really in a pinch for time.”) CSOs will encourage their members to use the cars, but have to tread a very fine rhetorical line to encourage “exploration” and “new experiences” rather than just driving more.

Put these together, and car sharing is a maturing service which will continue to grow. However, it’s not something that’s ever going to turn a huge profit.

On the other end of the spectrum, current investors, like the esteemed (at least, when he’s getting yelled at by Jon Stewart) Jim Cramer, also have things wrong. They argue against buying Zipcar shares because they fear big car rental agencies are going to push in to Zipcar’s turf and take over its business. If this was the case, it would have happened by now. But car rental agencies have a different business model, and they’re not about to change their stable, successful businesses to jump in to something new, and something which barely makes money.

In other words, Hertz is not about to move their airport-based fleet of rental cars in to the middle of the city and take over Zipcar’s business. Their business model is to buy new cars, drive them for 25,000 miles, park them in big lots at an airport, and sell them within a year. They operate with very low overhead, comparatively few locations, and, outside of airports, limited hours. Some have made feints in to the car sharing market from static locations with limited pick-up times and key boxes; these have been unsuccessful. The only money they put in to their cars are 25¢ key rings, so they can sell off capital at a moment’s notice. They don’t have to invest in parking spaces, signs and space leasing agreements. They play the car market, and, from time to time they rent them out.

The one opportunity for car rental agencies is that the demand for rental cars and shared cars is flipped. Rental cars see low use on weekends, shared cars see low use on weekdays. If Hertz could magically move half their fleet from the airport to the city every Friday and back on Sunday night, they’d have something going. This, however, would mean driving their cars at high revenue and high traffic times, from one central location to dispersed spaces in residential areas. They’d have to install car sharing hardware which would only be used a few days a week, disable and reenable it to meet the whims of the rental car market, and convince traditional renters to drive a moving billboard. The logistical and personnel cost to do this would negate any potential savings.

There are also reverse opportunities for car sharing organizations: encouraging travelers to rent shared cars during the week—especially in cities with good transit links to airports. Imagine, for example, a business traveler going to the East Bay from SFO. She could get on the BART and ride it through San Francisco and under the Bay, avoid the usual traffic on the bridge and 101, and pick up a car in Berkeley from near a BART station. By the time a traveler bound for a location west of Boston was at the desk after a rental car shuttle trip at Logan, they could take the Silver Line to the Seaport, grab a Zipcar, and jump on the Pike. If anything, I think there’s more of a market for traditional car renters to use shared cars than the other way around, especially as business travelers become more likely to be city-adept car sharing members and less likely to own a car. (Plus, from an expense-reporting standpoint, it’s easier to expense one item, a rental car, than a rental car and gas purchases.) But for the most part I expect car sharing and car rental to remain separate business segments as this would only be feasible in markets with sizable car sharing markets, good airport transit and cross-city reciprocity (right now, only Zipcar).

So, car sharing will continue to be successful, but never wildly profitable. If shares were to fall far enough and Zipcar shows continued profitability, I could see it being a decent investment, but not one that would ever run up Apple- or Google-like returns. For now, I’m staying away.