I drove out to Syracuse over the holidays. When I filled up with gas in Massachusetts, the going rate ranged from $3.30 to $3.45, at least outside of downtown (where the cost of land and logistics raise the price somewhat). In Syracuse, however, most stations were in the $3.60 range, and I held my nose (although not too hard; I had borrowed a Prius for the trip so even a full tank ran under $30) and filled up.

And I got to thinking: why is gas in Massachusetts so much cheaper? I know why it’s cheaper than New York City, where gas stations take up precious land and you can’t build above them (because how scary would it be to live in a building sitting atop a bomb)? But upstate? Does delivery cost more? Are there some extra regulations in New York and not Massachusetts? Is the gas tax higher?

Oh, right, the gas tax is higher.

Massachusetts has a middling gas tax of 23.5¢ per gallon, 24th lowest in the country (and it hasn’t gone up in more than 20 years). New York’s tax is the highest in the US, more than doubling Massachusetts at 51.3¢. (Here’s Wikipedia on gas taxes by state including the federal 18.4¢ tax). New York’s economy seems to get along fine, and the gas taxes assuredly help New Yorkers fund their transportation network.

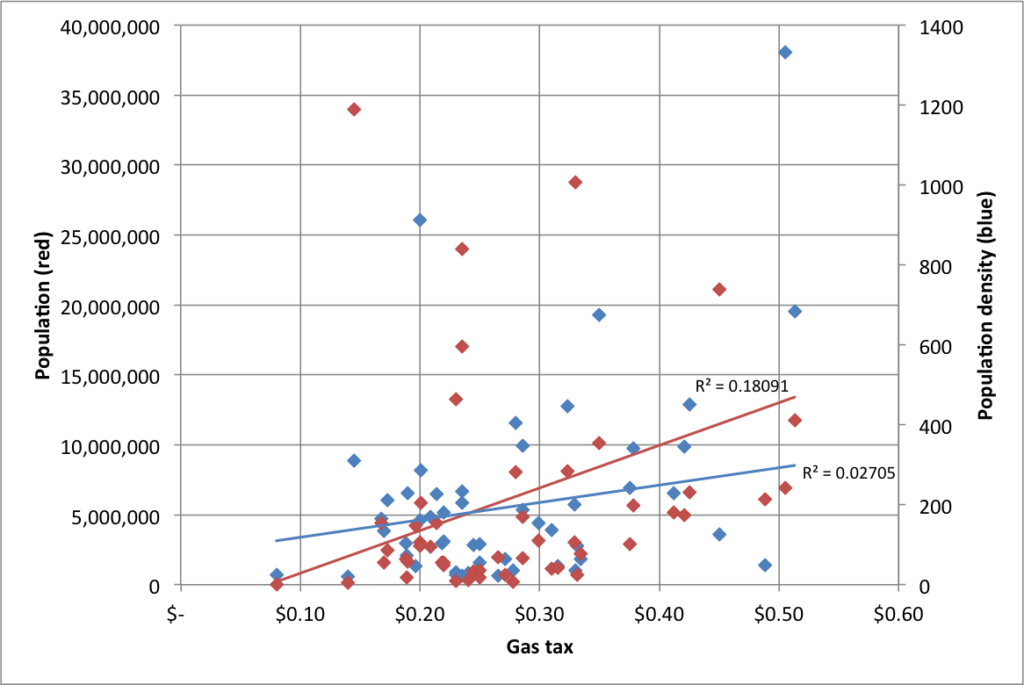

But Massachusetts lags even the national average of 27.5¢ per gallon. Gas prices are relatively well-correlated to state population (but, surprisingly, not by population density; see charts at the end of this post), so small, low-tax states skew this mean. Weighing the average by population shows that the average American pays a gas tax of 32.1¢ per gallon.

What about the region? How does Massachusetts compare against its neighbors, if not the whole country?

| New York |

51.3¢

|

Maine |

31.5¢

|

| Connecticut |

45¢

|

Vermont |

26.5¢

|

| Rhode Island |

33¢

|

New Hampshire |

19.6¢

|

Except for Live Free or Die New Hampshire, Massachusetts’ neighboring states pay higher gas taxes. Even in rural Maine and Vermont, where there are few transit options, gas taxes are higher. New York and Connecticut have dramatically higher taxes (putting thems in the top-10 highest gas tax states). Massachusetts seems like an anomaly here with lower gas taxes despite higher-priced neighbors and a transportation system which desperately needs the money.

The average in the region? 34.5¢. The weighted average? 46.7¢ (New York accounts for 71% of the population; Connecticut another 13%.)

Now, what would an increase gas tax would raise in Massachusetts? Last year, the MAPC put out a great MBTA budget calculator to try to close the gap in T funding. By their estimates, every 1¢ rise in the gas tax nets $27.7 million per year. Since even a 25¢ rise only accounts for a 7% rise in the overall gas price, we can assume that the gas tax wouldn’t decrease demand for fuel dramatically (demand for gasoline is quite inelastic). So here are some scenarios:

- Match the national average of 27.5¢. Annual revenues: $110 million.

- Match the national weighted average of 32.1¢. Annual revenues: $238 million.

- Match the regional average of 34.5¢. Annual revenues of $305 million

- Match the regional weighted average of 46.7¢. Annual revenues of $656 million

- Match New York’s gas tax of 51.3¢. Annual revenues of $770 million

What if we raised the gas tax by 15¢ per gallon over three years—a nickel per year—and then did something really smart and indexed it to inflation? First of all, we’d still a ways from the top of the list of states by gas taxes. Three years out, we’d have somewhere along the lines of $400 million in additional gas tax revenue per year. I see this splitting in to five pots:

- MBTA operating subsidies. This could be 5¢ per gallon, although such a static cap could lead to issues if tax revenue lags like sales tax revenue did in the current budget predicament. Still, if there isn’t a huge debt transfer to the T (like there was in 2000) it would be less of a concern. (This 5¢ could also go towards Big Dig debt repayment, or that could come out of other portions of the tax.)

- RTA operating subsidies. 1¢ per gallon. Massachusetts regional transit authorities provide transit service to many cities and towns outside of the Boston area, and dedicated funding could allow them to improve and add service, as many operate limited schedules on only some days of the week. (The RTAs have less than 1/10th the ridership of the MBTA, so this is a higher per-rider subsidy and would help bring the votes of legislators from further afield.)

- Transit infrastructure improvements and projects. 4¢ per gallon. This money could probably be used to leverage private, local and federal funding.

- Highway infrastructure improvements and projects. 4¢ per gallon. This money would also probably help to leverage matching federal dollars.

- Bicycling and pedestrian improvements. 1¢ per gallon. It’s a small chunk of the puzzle, but $25 million per year would go a long way.

State policymakers in Massachusetts seem to realize that something has to be done about transportation funding. In the midst of the recession, business leaders called for a 25¢ gas tax hike. In 2009. 25¢ would give another $300 million per year for things like infrastructure improvements and debt payments (although it would still fall short of some estimates of the need for infrastructure improvements). This is the kind of sensible changes that we will need in order to have a functional transportation system. And if we look to our neighbors, we can see that, despite concern trolling (this article has a sad story about a guy filling up his wife’s Lincoln Navigator who might get hit for $500 a year—but apparently can afford to own and drive a 16 mpg Navigator) that always bubbles up when the gas tax is mentioned, raising the tax enough to begin to pay for our transportation system is certainly feasible.

As mentioned above, here’s a chart of gas taxes by population and density:

A quick note on Vehicle Miles Traveled taxing, or VMT: it may be a more palatable alternative to gas taxes, but it’s bad policy. First of all, it would require significant infrastructure to require people to have their odometers read, probably at a state inspection. It would also incentivize people to register their cars out of state, which is not a particularly difficult thing to do, especially for a state with a lot of migration in and out. Finally, a VMT tax disincentivizes driving, while a gas tax pulls double duty and discourages driving and the purchase of larger, less efficient vehicles. In other words, there is no logical argument for a VMT over a gas tax.

I think you might be missing one variable when considering how a higher tax would impact demand: presently people who live in NY, CT, & RI go to Massachusetts specifically to buy gas. I do. I live in CT, about 4 miles south of the MA border.

When I go fill up my gas tank, I also do my grocery shopping, grab a bite to eat, go to the laundromat, go to the package store (MA doesn't have a liquor tax like CT does), and probably go grab a few things at Home Depot or WalMart.

If there was no tax advantage in me going to MA for my gas, I probably wouldn't be doing all those other things while I'm there.

Right now gas is $.20 to $.25 cheaper in MA. It's really not that much on 15 gallons (I guess it's more mental than anything), but if the street prices were only $.05 cheaper? I would not plan my errands around where I'm going to fill up.